CFA. Level 1. Book 4. Corporate Finance, Portfolio Management, and Equity Investments 2015

4.7

Reviews from our users

You Can Ask your questions from this book's AI after Login

Each download or ask from book AI costs 2 points. To earn more free points, please visit the Points Guide Page and complete some valuable actions.Related Refrences:

Introduction to the Book

Welcome to the 'CFA Level 1 Book 4: Corporate Finance, Portfolio Management, and Equity Investments 2015'. This book is an essential guide for candidates pursuing the Chartered Financial Analyst (CFA) designation. It delves into three core areas vital for any finance professional: Corporate Finance, Portfolio Management, and Equity Investments. With an integrated approach to these subjects, this book provides a robust foundation for successfully navigating the challenging CFA Level 1 exam and enhancing your financial analysis and investment management skills.

Detailed Summary

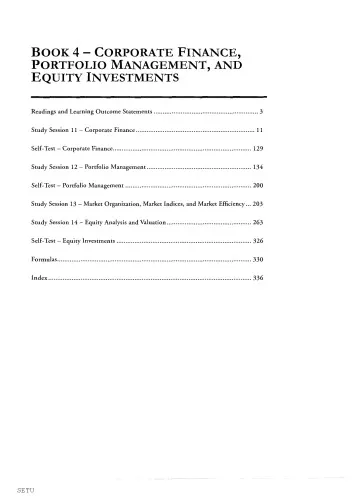

This book covers three critical components of the CFA curriculum, beginning with Corporate Finance. In this section, readers will explore topics such as capital budgeting, financial structure, and the intricacies of corporate governance. Understanding these concepts is crucial for making informed managerial decisions and for understanding the strategic implications of financial decision-making within a corporation.

The Portfolio Management section introduces the key principles of managing investments. It emphasizes the importance of diversification, asset allocation, and risk management. Readers will also gain insights into the different approaches to constructing and evaluating investment portfolios, drawing from both traditional and modern portfolio theories.

In the Equity Investments section, the book provides an in-depth exploration of equity markets and instruments. It discusses valuation techniques, market efficiencies, and the processes involved in analyzing industries and companies. This section equips aspiring financial analysts with the tools necessary for evaluating stocks and making informed investment decisions.

Key Takeaways

- Comprehensive understanding of corporate finance principles, including capital structure and budgeting.

- Mastery of portfolio management fundamentals, focusing on risk-return trade-offs and portfolio diversification strategies.

- Advanced insights into equity investments, providing the skills needed for thorough financial analysis and valuation.

- Notable emphasis on practical application, preparing candidates for real-world financial and investment decision-making.

Famous Quotes from the Book

"Corporate Finance is not just about maintaining the financial health of a company—it's about strategic planning and decision-making for sustainable growth."

"An effectively managed portfolio mirrors the intricate balance between risk and opportunity, aligning investment goals with market realities."

"In the world of equity investments, profound insights and accurate valuations are the differentiators between speculation and informed investment."

Why This Book Matters

'CFA Level 1 Book 4: Corporate Finance, Portfolio Management, and Equity Investments 2015' is a cornerstone for those embarking on a career in finance. As part of the esteemed CFA curriculum, it embodies a rigorous and comprehensive approach to investment education, ensuring candidates are well-prepared to meet global standards.

This book is crucial not only for passing the CFA Level 1 exam but also for developing a deep and practical understanding of key financial principles. The insights gained from this book extend beyond exam preparation, offering the knowledge and confidence needed to excel in various roles within the financial industry.

Furthermore, the book's focus on real-world application and strategic decision-making sets it apart as an invaluable resource for both aspiring and seasoned finance professionals. By grounding theoretical knowledge in practical examples, it bridges the gap between classroom learning and the complexities of modern financial markets.

Free Direct Download

You Can Download this book after Login

Accessing books through legal platforms and public libraries not only supports the rights of authors and publishers but also contributes to the sustainability of reading culture. Before downloading, please take a moment to consider these options.

Find this book on other platforms:

WorldCat helps you find books in libraries worldwide.

See ratings, reviews, and discussions on Goodreads.

Find and buy rare or used books on AbeBooks.

1343

بازدید4.7

امتیاز0

نظر98%

رضایتReviews:

4.7

Based on 0 users review

Questions & Answers

Ask questions about this book or help others by answering

No questions yet. Be the first to ask!