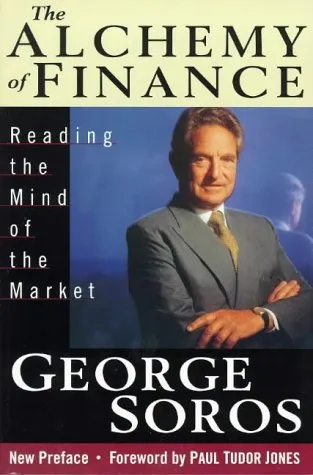

The Alchemy of Finance: Reading the Mind of the Market

4.2

Reviews from our users

You Can Ask your questions from this book's AI after Login

Each download or ask from book AI costs 2 points. To earn more free points, please visit the Points Guide Page and complete some valuable actions.George Soros's "The Alchemy of Finance: Reading the Mind of the Market" stands as a pioneering work in the field of financial literature, offering a profound insight into how markets operate and how one can read and predict their movements. Soros combines his conceptual approach with practical investment experiences, providing a comprehensive framework for understanding the complex financial world.

Detailed Summary of the Book

In "The Alchemy of Finance," George Soros explores the concept of "reflexivity," a theory he developed to explain how markets operate. Reflexivity suggests that investor perceptions influence market realities, and these altered realities in turn influence investor perceptions in a continuous feedback loop. Soros delves deep into the flaws of traditional economic theories, particularly the notion of perfect information and efficient markets, arguing instead that markets are far more unpredictable and subjective.

The book is divided into two parts. The first focuses on Soros's theoretical framework, laying the groundwork for understanding the reflexive interaction between thinking and reality. The second part is more practical, providing a detailed account of Soros’s investment activities and decisions, particularly during the high-stakes periods of financial turbulence.

Key Takeaways

- Reflexivity: Understanding how our perceptions influence market fundamentals and vice versa.

- Market Dynamics: Learning that markets are not always rational and can be swayed by emotions and misconceptions.

- Investment Strategies: Insights into successful investment methods that account for market unpredictability and irrationality.

- Cognitive Bias: Recognizing human errors in judgment that impact financial markets.

Famous Quotes from the Book

"Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected."

“The financial markets generally are unpredictable. So that one has to have different scenarios. The idea that you can actually predict what's going to happen contradicts my way of looking at the market.”

Why This Book Matters

"The Alchemy of Finance" is an essential read for both novice investors and seasoned financial professionals. George Soros's revolutionary concept of reflexivity challenges the traditional economic thinking and provides a critical perspective on how market behaviors can deviate from theoretical predictions. His experiences and formulations offer invaluable lessons in navigating the inherent uncertainties of financial markets. The book’s insights into market psychology have been influential in rethinking financial market dynamics and investment strategies.

Furthermore, Soros's narrative goes beyond finance and economics, providing a richer understanding of social phenomena, and how predictions and expectations shape not just economic outcomes but also political and social ones. In a world where financial markets are intricately linked to global events, understanding the principles Soros presents could be the difference between success and failure for investors.

Free Direct Download

You Can Download this book after Login

Accessing books through legal platforms and public libraries not only supports the rights of authors and publishers but also contributes to the sustainability of reading culture. Before downloading, please take a moment to consider these options.

Find this book on other platforms:

WorldCat helps you find books in libraries worldwide.

See ratings, reviews, and discussions on Goodreads.

Find and buy rare or used books on AbeBooks.

1237

بازدید4.2

امتیاز50

نظر98%

رضایتReviews:

4.2

Based on 0 users review

"کیفیت چاپ عالی بود، خیلی راضیام"

Questions & Answers

Ask questions about this book or help others by answering

No questions yet. Be the first to ask!