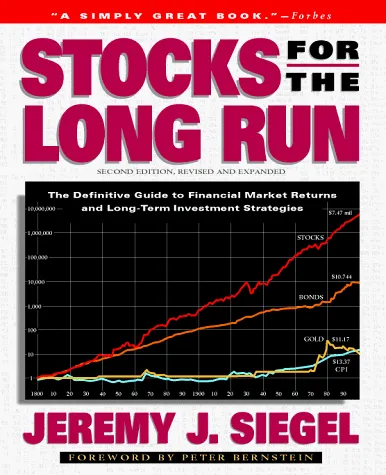

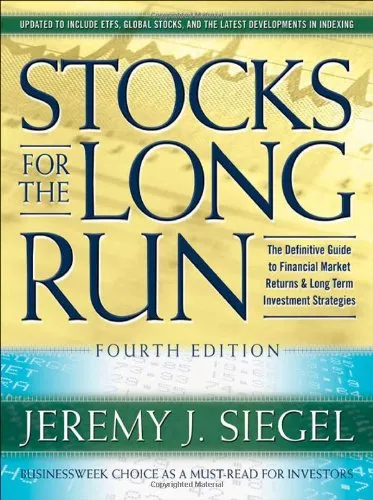

Stocks for the long run: the definitive guide to financial market returns and long-term investment strategies

4.5

Reviews from our users

You Can Ask your questions from this book's AI after Login

Each download or ask from book AI costs 2 points. To earn more free points, please visit the Points Guide Page and complete some valuable actions.Related Refrences:

Introduction to 'Stocks for the Long Run'

Embark on a comprehensive journey through the intricate world of stocks and investments with 'Stocks for the Long Run: The Definitive Guide to Financial Market Returns and Long-Term Investment Strategies' by Jeremy J. Siegel. This authoritative tome sheds light on the essential strategies that investors must adopt to capitalize on the power of stocks over the long term. With decades of experience and research distilled into its pages, this book aims to empower investors with timeless principles of stock market investing.

Detailed Summary of the Book

Within 'Stocks for the Long Run', Siegel delves into the historical performance of stocks, demonstrating how equities have consistently outperformed other asset classes over extended periods. The book meticulously analyzes data spanning centuries to reveal patterns and insights that are crucial for understanding market trends. Siegel emphasizes the importance of a long-term perspective, advocating for patience and strategic investment approaches in the face of market volatility.

Furthermore, the book provides a deep dive into various economic factors and their influence on stock performance. Topics like inflation, interest rates, and market cycles are explored with rigorous analysis, offering readers a robust framework to anticipate and react to market changes. Siegel also contrasts the performance of stocks with bonds, gold, and other investment avenues, empowering readers with a comparative understanding.

Key Takeaways

- Historical Evidence: The book presents compelling data that highlights stocks' superior performance over long periods compared to other asset classes.

- Importance of Diversification: Siegel underscores the necessity of diversifying investments to mitigate risks and enhance potential returns.

- Market Predictability: By understanding historical trends and economic indicators, investors can better predict and navigate future market movements.

- Strategic Patience: Emphasizing the virtue of patience, the book stresses that enduring short-term volatility is essential for harvesting long-term gains.

- Economic Factors Influence: A detailed exploration of how macroeconomic variables like inflation can have a profound impact on stock returns.

Famous Quotes from the Book

"In the long run, fear and greed are the twin forces that drive investment decisions, and only historical perspective can keep them in balance."

"A stock’s value is its discounted stream of dividends, and this fundamental principle is what stands the test of time."

Why This Book Matters

In a world characterized by financial uncertainty and complex markets, 'Stocks for the Long Run' emerges as a crucial resource for both novice and seasoned investors. It arms readers with proven investment strategies backed by rigorous historical analysis, empowering them to make informed decisions. The book provides a blend of quantitative research and practical advice, ensuring that investors not only understand market theories but also apply them effectively.

Jeremy Siegel's work stands as a testament to the enduring power of stock markets as vehicles for wealth generation. With its focus on long-term gains, this book argues against the temptation of short-term speculation, instead encouraging readers to adopt disciplines that have been shown to succeed through the ages.

By integrating sound economic theory with real-world insights, 'Stocks for the Long Run' remains an indispensable guide for anyone looking to harness the historical strength of equities for future prosperity. Its relevance in today's volatile market landscape cannot be overstated, making it a must-read for those striving to secure their financial future.

Free Direct Download

You Can Download this book after Login

Accessing books through legal platforms and public libraries not only supports the rights of authors and publishers but also contributes to the sustainability of reading culture. Before downloading, please take a moment to consider these options.

Find this book on other platforms:

WorldCat helps you find books in libraries worldwide.

See ratings, reviews, and discussions on Goodreads.

Find and buy rare or used books on AbeBooks.

1470

بازدید4.5

امتیاز0

نظر98%

رضایتReviews:

4.5

Based on 0 users review

Questions & Answers

Ask questions about this book or help others by answering

No questions yet. Be the first to ask!