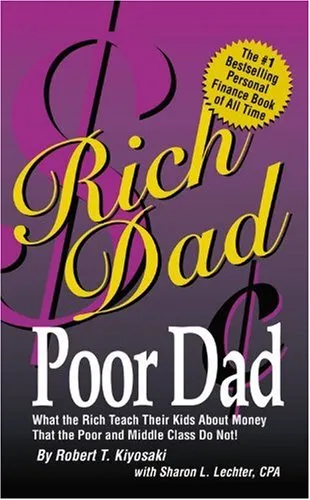

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money-That the Poor and the Middle Class Do Not!

5.0

Reviews from our users

You Can Ask your questions from this book's AI after Login

Each download or ask from book AI costs 2 points. To earn more free points, please visit the Points Guide Page and complete some valuable actions.Related Refrences:

Introduction to 'Rich Dad Poor Dad'

Welcome to this comprehensive introduction to 'Rich Dad Poor Dad', a bestselling personal finance book by Robert T. Kiyosaki. Published in 1997, it challenges conventional beliefs about money and delivers a transformative blueprint for achieving financial freedom. In the pages of this book, you'll uncover the differences in mindset, education, and values between Kiyosaki's two father figures—his real father (Poor Dad) and his best friend’s father (Rich Dad).

Detailed Summary of the Book

The essence of 'Rich Dad Poor Dad' revolves around the unique perspectives presented by two paternal influences on Kiyosaki's life. Poor Dad, his biological father, is a highly educated professional but struggles financially throughout his life, reinforcing the traditional belief that academic success leads to career success. Conversely, Rich Dad, his best friend's father, embraces entrepreneurship and financial literacy, teaching Kiyosaki lessons about money not found in conventional schooling.

The book is structured around several pivotal lessons, with emphasis on assets and liabilities, the importance of financial education, and the courage to take financial risks. Kiyosaki expounds on the concept that it’s not about how much money you make—it's about how much money you keep, how hard it works for you, and how many generations you keep it.

Key Takeaways

Below are some of the crucial insights gained from 'Rich Dad Poor Dad':

- Understand the difference between assets and liabilities. An asset puts money in your pocket, whereas a liability takes money out.

- Financial literacy is crucial for success. Schools do not teach this, so self-education is essential.

- Work to learn, not to earn. Gaining experience is more valuable in the long run.

- The importance of investing. Work to acquire income-generating assets to build wealth.

- Mind your own business. Keep your day job, but start acquiring assets that will generate income for you.

Famous Quotes from the Book

Here are some of the most impactful quotes from 'Rich Dad Poor Dad':

"The rich don’t work for money. They have their money work for them."

"Financial freedom is available to those who learn about it and work for it."

"The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth."

Why This Book Matters

The significance of 'Rich Dad Poor Dad' lies in its ability to demystify the myths surrounding wealth creation and financial independence. Robert Kiyosaki's narrative reveals that the conventional path of education and secure employment is not sufficient for wealth building. Instead, financial literacy, risk-taking, and an entrepreneurial mindset are pivotal. The book encourages readers to shift their mindset from earning a paycheck to building sustainable wealth through smart investments and financial prudence.

By providing readers with actionable insights and a powerful change in perspective, 'Rich Dad Poor Dad' empowers individuals to redefine their financial goals and create a more secure future. It is not merely a book about finance; it's a call to challenge the status quo and embark on a learning journey to harness the full potential of one's financial acumen.

Free Direct Download

You Can Download this book after Login

Accessing books through legal platforms and public libraries not only supports the rights of authors and publishers but also contributes to the sustainability of reading culture. Before downloading, please take a moment to consider these options.

Find this book on other platforms:

WorldCat helps you find books in libraries worldwide.

See ratings, reviews, and discussions on Goodreads.

Find and buy rare or used books on AbeBooks.

1556

بازدید5.0

امتیاز2

نظر98%

رضایتReviews:

5.0

Based on 2 users review

moises8

Sept. 19, 2025, 5:57 p.m.

Robert Kiyosaki's "Rich Dad Poor Dad" has been a cornerstone of personal finance literature for over two decades, and for good reason. It's a book that fundamentally shifts the reader's perspective on money, wealth, and the traditional path of "go to school, get a good job, and save." The book's central narrative, comparing the financial philosophies of Kiyosaki's highly educated but financially struggling "Poor Dad" and his friend's entrepreneurial and wealthy "Rich Dad," is a powerful and engaging way to illustrate his core concepts.

The primary strength of "Rich Dad Poor Dad" lies in its ability to simplify complex financial ideas. The distinction between an asset (something that puts money in your pocket) and a liability (something that takes money out of your pocket) is a particularly resonant and easily digestible concept that has empowered many readers to re-evaluate their spending habits. The book champions financial literacy, encouraging readers to invest in their financial education to understand how money works. This emphasis on building wealth through assets like real estate, businesses, and other investments, rather than relying solely on a traditional salary, has been a wake-up call for countless individuals stuck in the "rat race."

However, "Rich Dad Poor Dad" is not without its critics. Many financial experts point to the lack of concrete, actionable advice in the book. While it excels at shifting mindset, it's light on the specific "how-to" of investing. Some also criticize the book for its anecdotal nature and the questioning of whether "Rich Dad" was a real person or a composite character. Furthermore, some of the investment strategies hinted at in the book, such as using debt to acquire assets, can be risky for inexperienced investors.

Despite these criticisms, the enduring popularity of "Rich Dad Poor Dad" is a testament to its impact. It has successfully ignited an interest in personal finance for a massive audience and has encouraged a generation of readers to take control of their financial futures. While it shouldn't be the only financial book on your shelf, it serves as an excellent starting point for anyone looking to challenge their conventional thinking about money and begin the journey toward financial independence.

muhammad200

Jan. 7, 2026, 10:14 a.m.

Read this as an undergradute.

Gave me a better view of the world than my class room could ever had done

Questions & Answers

Ask questions about this book or help others by answering

No questions yet. Be the first to ask!