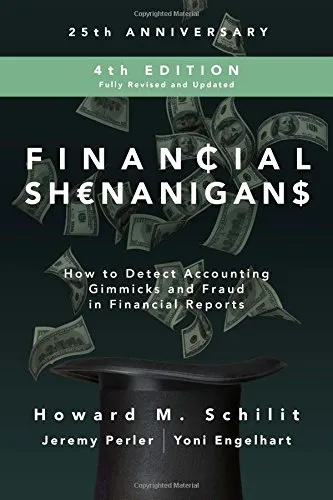

Financial Shenanigans: How to Detect Accounting Gimmicks and Fraud in Financial Reports

4.5

Reviews from our users

You Can Ask your questions from this book's AI after Login

Each download or ask from book AI costs 2 points. To earn more free points, please visit the Points Guide Page and complete some valuable actions.Related Refrences:

In the world of finance, where numbers dictate the rise and fall of fortunes, transparency and accuracy are not just desired—they are critical. Yet, the landscape is often muddied by the shadow of financial shenanigans. "Financial Shenanigans: How to Detect Accounting Gimmicks and Fraud in Financial Reports" by Howard M. Schilit, Jeremy Perler, and Yoni Engelhart is an invaluable guide for investors, analysts, and finance professionals seeking the truth behind the numbers. This book equips readers with tools and insights to spot and understand deceptive practices in financial reporting.

Detailed Summary of the Book

Financial Shenanigans offers a meticulous exploration into the realm of accounting tricks and financial misreporting. It demystifies the complex world of financial statements, revealing the subtle and overt ways in which companies manipulate data. The authors dissect various accounting gimmicks across multiple dimensions, providing real-world examples that illustrate each concept vividly. The revised edition incorporates insights from the latest financial disasters, ensuring relevance in today's ever-evolving financial landscape. Readers will learn to dissect cash flow manipulations, revenue recognition tricks, and the intricacies of expense management that executives often exploit to meet or exceed projections.

Key Takeaways

One of the primary takeaways from the book is the significance of skepticism in financial analysis. Readers are encouraged to go beyond the headline numbers and decipher the underlying realities of financial statements. The book teaches how to identify red flags and warning signs that suggest manipulation, such as unusual spikes in revenue or unexplained adjustments in accounting estimates. By mastering these techniques, investors can better protect themselves from fraudulent practices and make more informed financial decisions.

Famous Quotes from the Book

"To make numbers lie, management must ensure that those lies go undetected for as long as possible."

"Ethics, integrity, and transparency are the pillars on which trust in financial statements rests."

"Read beyond the headlines; the truth often lies in the fine print."

Why This Book Matters

In an era where corporate scandals can lead to massive financial downfall, understanding accounting fraud is more important than ever. This book serves as a timely and crucial resource for anyone involved in financial reporting or investment decision-making. It empowers professionals to act as vigilant gatekeepers, ensuring that the corporate truths they seek are not clouded by deceit. As businesses become more complex, the techniques outlined in this book become invaluable tools for maintaining the integrity of financial markets.

Free Direct Download

You Can Download this book after Login

Accessing books through legal platforms and public libraries not only supports the rights of authors and publishers but also contributes to the sustainability of reading culture. Before downloading, please take a moment to consider these options.

Find this book on other platforms:

WorldCat helps you find books in libraries worldwide.

See ratings, reviews, and discussions on Goodreads.

Find and buy rare or used books on AbeBooks.

1281

بازدید4.5

امتیاز0

نظر98%

رضایتReviews:

4.5

Based on 0 users review

Questions & Answers

Ask questions about this book or help others by answering

No questions yet. Be the first to ask!