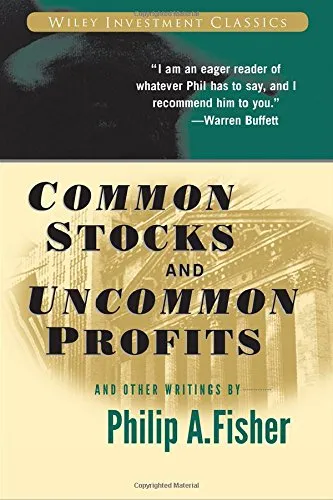

Common Stocks and Uncommon Profits and Other Writings (Wiley Investment Classics)

4.5

Reviews from our users

You Can Ask your questions from this book's AI after Login

Each download or ask from book AI costs 2 points. To earn more free points, please visit the Points Guide Page and complete some valuable actions.Related Refrences:

An Introduction to "Common Stocks and Uncommon Profits and Other Writings"

Written by Philip A. Fisher, "Common Stocks and Uncommon Profits and Other Writings" is a profound classic that delves into the art and science of investing. Known for its timeless advice on what to look for in a company's stock, this book has been instrumental in shaping the investment philosophies of many successful investors, including the legendary Warren Buffett.

Detailed Summary of the Book

Philip A. Fisher's work is a comprehensive guide to understanding the dynamics of stock market investment. At its core, the book underscores the significance of thorough research and analysis beyond mere numbers. Fisher introduces a qualitative approach to investing, focusing on factors such as the company's management quality, competitive advantages, and growth potential.

The book is divided into three parts, each illuminating different aspects of investing. The first part covers the investment philosophies of Fisher, where he discusses the fifteen points to look for in a common stock, such as the company's long-term growth prospects and management integrity. The second part delves into the decisions that investors need to avoid, emphasizing the importance of patience and perseverance. The final part includes additional writings, offering insights into the evolution of Fisher's original ideas and how they adapt to the changing market environments.

Key Takeaways

- Long-term Investment: Fisher advocates for a long-term investment perspective, focusing on the sustainable growth potential of companies rather than short-term market trends.

- Qualitative Analysis: He emphasizes qualitative over quantitative metrics, encouraging investors to look into less tangible aspects such as corporate culture and customer relationships.

- The Importance of Management: A key focus is on evaluating the quality of a company's management team, as it significantly influences a company's success and longevity.

- Prudent Investment Decisions: Fisher advises avoiding over-diversification and paying attention to companies with unique market niches.

- Adaptability in Investing: Staying informed about market developments and adapting old investment principles to new contexts is crucial.

Famous Quotes from the Book

"The stock market is filled with individuals who know the price of everything, but the value of nothing."

"The greatest investment opportunity lies in purchasing small pieces of a company that guarantees above-average profits over the years."

Why This Book Matters

"Common Stocks and Uncommon Profits and Other Writings" remains a seminal work in the world of investing because it reshapes the way investors perceive common stocks, emphasizing the broader picture rather than getting bogged down by fleeting stock prices. Fisher's teachings advocate for a more introspective approach that promotes intellectual discipline and thorough research beyond financial statements.

The book is particularly relevant for modern investors who seek to build a solid investment strategy grounded in deep understanding and patience. By applying Fisher's principles, investors can learn to identify exceptional investment opportunities and cultivate resilient portfolios that withstand the test of time.

Free Direct Download

You Can Download this book after Login

Accessing books through legal platforms and public libraries not only supports the rights of authors and publishers but also contributes to the sustainability of reading culture. Before downloading, please take a moment to consider these options.

Find this book on other platforms:

WorldCat helps you find books in libraries worldwide.

See ratings, reviews, and discussions on Goodreads.

Find and buy rare or used books on AbeBooks.

1398

بازدید4.5

امتیاز0

نظر98%

رضایتReviews:

4.5

Based on 0 users review

Questions & Answers

Ask questions about this book or help others by answering

No questions yet. Be the first to ask!