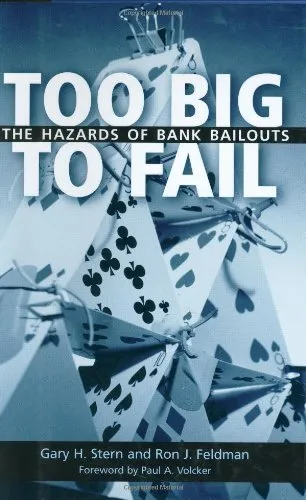

The Bank Recovery and Resolution Directive: Europe’s Solution for "Too Big To Fail"?

4.5

بر اساس نظر کاربران

شما میتونید سوالاتتون در باره کتاب رو از هوش مصنوعیش بعد از ورود بپرسید

هر دانلود یا پرسش از هوش مصنوعی 2 امتیاز لازم دارد، برای بدست آوردن امتیاز رایگان، به صفحه ی راهنمای امتیازات سر بزنید و یک سری کار ارزشمند انجام بدینکتاب های مرتبط:

Introduction

The financial crisis of 2008 unveiled the systemic vulnerabilities and inefficiencies of financial institutions worldwide, necessitating robust regulatory frameworks to mitigate future risks. The Bank Recovery and Resolution Directive (BRRD), a pivotal legislative instrument, emerged as a cornerstone of Europe's approach to addressing the 'Too Big To Fail' phenomenon. This book delves deeply into the intricacies of the BRRD, providing readers with a comprehensive understanding of its mechanisms and implications for the European banking landscape.

Detailed Summary of the Book

The book meticulously examines the genesis, evolution, and impact of the BRRD. It starts by setting the context of the global financial crisis, offering a historical overview of key events that catalyzed the need for comprehensive banking reform. As the directive was conceived to prevent taxpayers from bearing the brunt of bank failures, its primary aim is to ensure that failing institutions can be resolved without jeopardizing the broader economic stability.

The book unfolds the structural elements of the BRRD including the pivotal role of the Single Resolution Mechanism (SRM) and the Single Supervisory Mechanism (SSM). Each chapter dissects the components of the directive such as recovery planning, resolution planning, and the bail-in tool. Special attention is given to case studies where these mechanisms have been applied, providing real-world insights into their effectiveness and areas for improvement.

Key Takeaways

- Understanding BRRD: Gain an in-depth understanding of the BRRD’s framework and how it addresses systemic risks within the banking sector.

- Preventive and Curative Measures: Learn about the preventive measures incorporated within the directive, such as recovery and resolution planning, alongside curative measures like bail-ins.

- Europe's Financial Stability: Explore the broader implications of the BRRD on European financial stability and its role in transforming the regulatory landscape.

- Lessons from Case Studies: Analyze detailed case studies to understand the practical application and hurdles faced during the implementation of the BRRD.

Famous Quotes from the Book

"The BRRD is not merely a policy instrument; it is a testament to Europe's commitment to safeguarding financial stability while ensuring that public funds are not the first line of defense against bank failures."

"In navigating the thin line between regulatory intervention and economic freedom, the BRRD sets a precedent in balancing institutional accountability and systemic resilience."

Why This Book Matters

For policymakers, regulators, and finance professionals, understanding the BRRD is crucial as it represents a seismic shift in how Europe manages failing financial institutions. This book elucidates complexities with clarity, making it an indispensable resource for anyone keen on grasping the nuanced dynamics of modern banking regulations.

Amidst ongoing economic challenges and regulatory evolutions, this book provides a critical analysis that not only informs but also equips readers with the knowledge to engage in meaningful discussions about the future of banking regulation. Whether you're an academic, a practitioner, or simply interested in the financial stability of Europe, this book offers valuable insights into how one directive attempts to solve the pervasive problem of banks being 'Too Big To Fail'.

دانلود رایگان مستقیم

شما میتونید سوالاتتون در باره کتاب رو از هوش مصنوعیش بعد از ورود بپرسید

دسترسی به کتابها از طریق پلتفرمهای قانونی و کتابخانههای عمومی نه تنها از حقوق نویسندگان و ناشران حمایت میکند، بلکه به پایداری فرهنگ کتابخوانی نیز کمک میرساند. پیش از دانلود، لحظهای به بررسی این گزینهها فکر کنید.

این کتاب رو در پلتفرم های دیگه ببینید

WorldCat به شما کمک میکنه تا کتاب ها رو در کتابخانه های سراسر دنیا پیدا کنید

امتیازها، نظرات تخصصی و صحبت ها درباره کتاب را در Goodreads ببینید

کتابهای کمیاب یا دست دوم را در AbeBooks پیدا کنید و بخرید

1397

بازدید4.5

امتیاز0

نظر98%

رضایتنظرات:

4.5

بر اساس 0 نظر کاربران

Questions & Answers

Ask questions about this book or help others by answering

No questions yet. Be the first to ask!